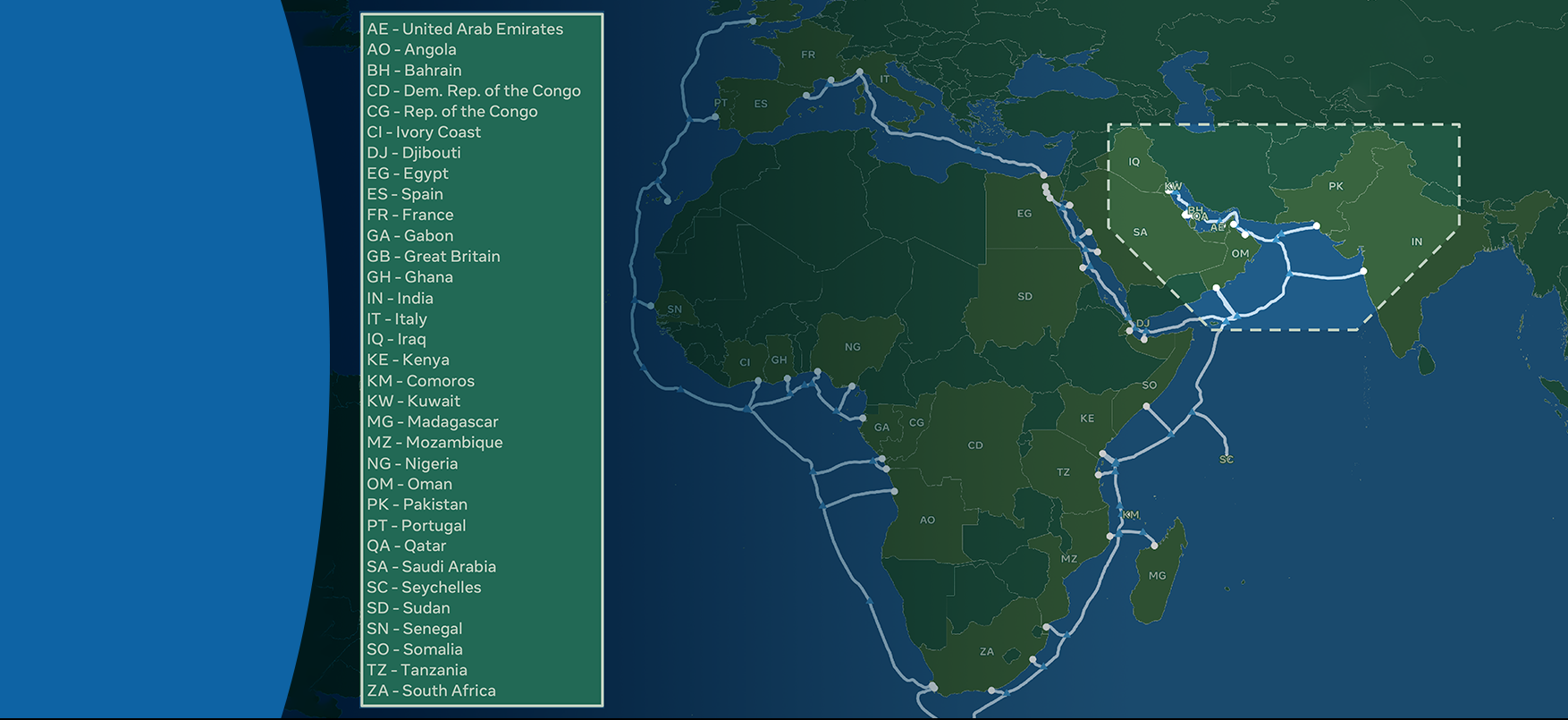

MTN Group is today pleased to announce a solid set of third quarter operating results, plans for a public offer of shares in MTN Nigeria, progress in finalising a passive infrastructure deal for MTN South Africa as well as in our work to create shared value across our 20 markets, with ESG at the core.

For the quarter to end-September 2021, the Group also reduced debt and holding company leverage, recorded strong financial results in line with medium-term guidance and advanced the delivery of our Ambition 2025 strategy.

“It’s been a busy quarter, and I’m particularly pleased with the sustained operational momentum across our businesses,” said MTN Group President and Chief Executive Officer Ralph Mupita.

“Material progress was made in accelerating the deleveraging of the holding company balance sheet, and our asset realisation programme and portfolio optimisation priorities are progressing well. The process of structurally separating our fintech and fibre assets remains on track.”

He added that the debt reduction led to S&P upgrading MTN’s standalone credit rating to investment grade – a level last achieved five years’ ago.

At period-end, the group subscriber base was 272m.

Driven by continued strong growth momentum in major markets Nigeria, Ghana and South Africa, MTN Group’s service revenue ramped up 19.1% to R125 billion in the first nine months of the year. Data and fintech service revenue increased by 34.5% and 35.0% respectively. Earnings before interest, tax, depreciation and amortisation (EBITDA) increased by 24.1%, with margins expanding 2.1 percentage points to 45.0% on a constancy-currency basis.

We advanced financial inclusion, reaching 51 million Mobile Money customers in 16 markets, processing almost 20 000 transactions a minute, with the value of transactions up 67.2% year-on-year to US$175.5bn.

As part of our asset realisation programme, the listing of IHS was an important milestone, creating a liquidity platform for the future to deleverage further. Our further localisation in Uganda with the intention to sell 20% of the Group’s holding in MTN Uganda is in progress.

We are also announcing a public offer of just under 3% of shares in MTN Nigeria as part of the statement of intent communicated previously to further localise 14% of the Group’s holding in MTN Nigeria over the medium term. MTN South Africa is making good progress with a sale and leaseback of its towers.

Aligned to our commitment to achieve net zero by 2040, we started working with the Science-Based Targets initiative to reduce our emissions in line with climate science. In joining Business Ambition for 1.5°C, MTN became part of the UN-backed Race to Zero campaign. In recognition of the strides made in governance practices, our MSCI ESG rating was upgraded to ‘A’ from a rating of ‘BBB’.

Looking ahead, Mupita was encouraged that the number of new COVID-19 cases across Africa had started to slow, but said the pandemic continued to impact lives and livelihoods and demand for mobile services: “It highlights the vital importance of telecommunications as people rely on these services for information and to work, learn and entertain from home. We as MTN are well positioned to deliver and will invest in line with our capital allocation framework to capture these opportunities.”